The CRISPR patent landscape keeps on developing at an increasing pace in 2017, with now up to three new patent families published every day! We have searched, reviewed and categorized more than 1146 patent families, now surveyed in our just released 2017 CRISPR patent landscape report.

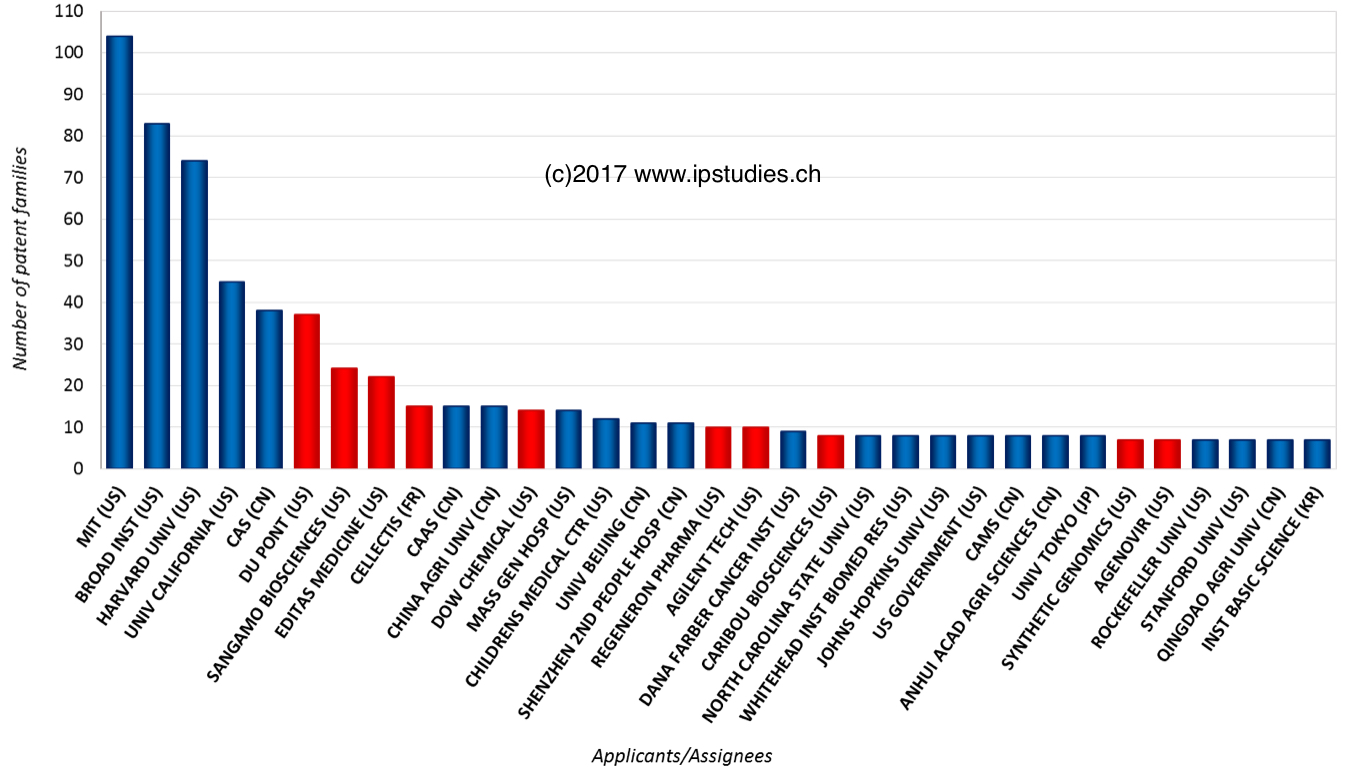

Since January 2016, the position of the top academic players MIT – Broad – Harvard and University of California has not significantly changed in the landscape of CRISPR inventions, as they have also more than doubled their patent families over the past year (corresponding to filings from mid 2014 to mid 2015). Their pioneering patent trench warfare seems further bogged down in the middle of incredibly complex and resource-consuming US patent office interference proceedings and European opposition proceedings – on January 31st, 2017, the Broad and MIT European legal counsel requested an extension of two months to finalize their answer to opposition proceedings so they have a chance to fully review more than 28000 pages of cited documents by seven different opponents, including an external expert opinion filed by CRISPR Therapeutics at the EPO to defend their case.

As the pioneering patent and license positions will not likely progress in the short term, we see relevant data for CRISPR IP positioning tactics in the remainder of the patent landscape. On the industrial side, Du Pont (SWX:DD), Sangamo (NASDAQ:SGMO), Editas (NASDAQ:EDIT), Cellectis (NASDAQ:CLLS) and Dow Chemicals (NYSE:DOW) remain the top 5 industrial applicants. Beyond them, Regeneron (NASDAQ:REGN) and Caribou Biosciences are still part of the main applicants while Sigma (NASDAQ:SIAL) and Takara (TYO:2531) are somewhat left behind the now significant portfolios of Agilent (NYSE:A), Agenovir and Synthetic Genomics. Academic players remain very present, in particular from China but also now from Japan and Korea research institutes.

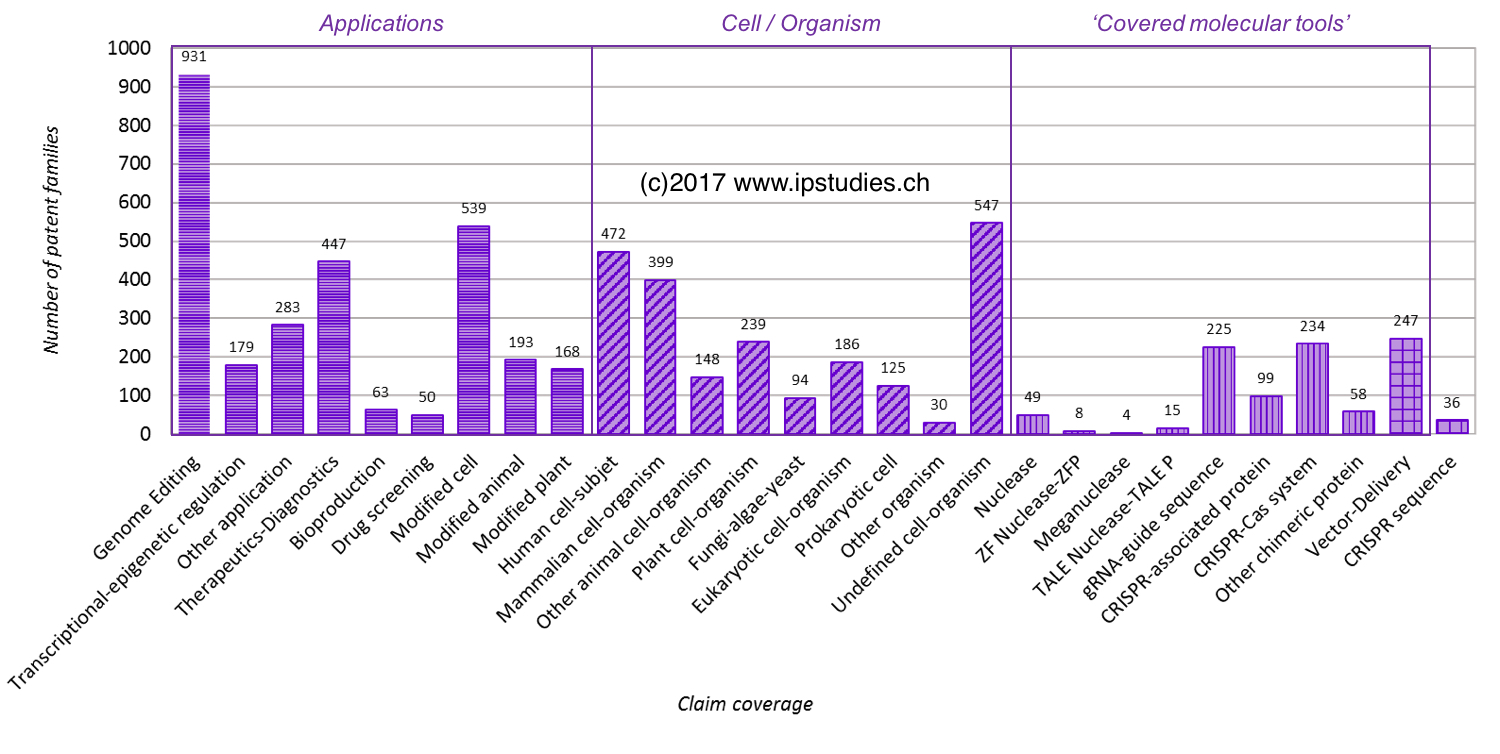

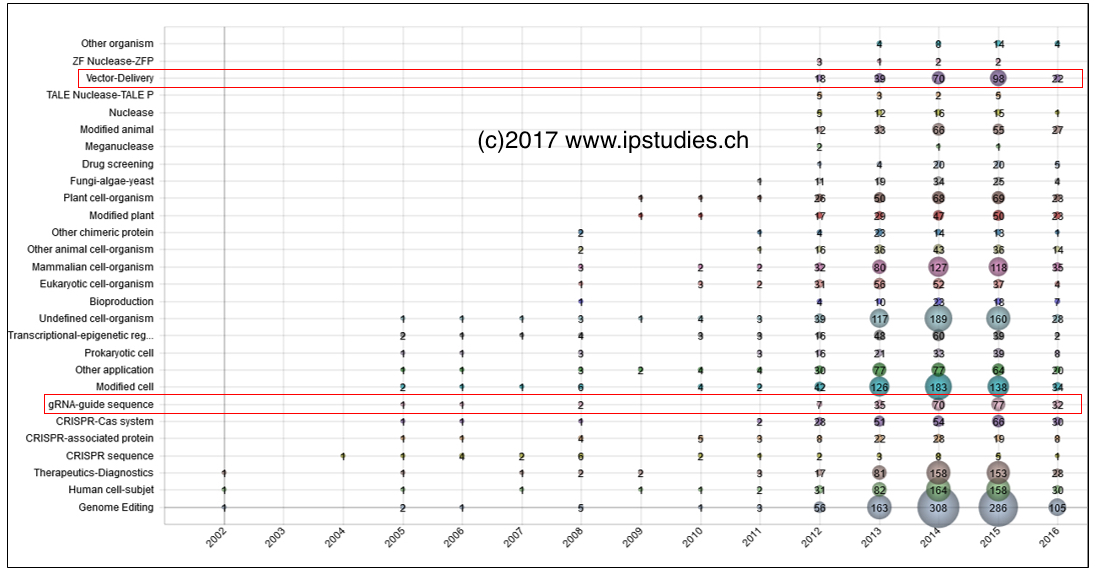

In terms of claim coverage, we notice trends in favor of modified cell applications, especially mammalian cells including human ones. The delivery and use of vectors, including viral vectors, as well as specific gRNA are also increasingly covered by patent applications.

Emerging alternatives to the Cas9 component, such as Cpf1, can also be found now in the patent landscape, which may indirectly impact the on-going patent disputes and was recently reflected in licensing arrangements between the pioneering researchers in the CRISPR engineering field and certain industry players. We’ve been closely monitoring related public announcements in the past three years and have detailed more than 40 licensing deals in our 2017 patent landscape report for your convenience.

You can order online your copy of our 2017 CRISPR patent analytics report including database access to the whole, historical, classified CRISPR patent landscape data so you can browse and focus on the specifics of your technology and application interests. You may also subscribe to monthly CRISPR patent database updates, thanks to our new partnership with Centredoc, the Swiss watch industry knowledge management cooperative. Download our CRISPR patent landscape sample, contact us for a video demo of the database functionality or visit our 2017 CRISPR patent analytics report to learn more!